November 2025

All About Scale, Not Science Projects

Welcome to TechLens™

TechLens™ is your monthly newsletter exploring the dynamic landscape of our core areas of expertise: Industrial IoT, Telecommunications, Edge Computing, and Autonomous Vehicles. Each issue provides a deep dive into the key developments from the previous month. Designed for technologists, leaders, and investors, this curated newsletter reveals the innovation and ambition transforming these sectors while highlighting promising growth opportunities and their potential economic impact.

All About Scale, Not Science Projects

November 2025 was the month autonomous vehicles stopped feeling like isolated pilots and started looking like a real network business.

Waymo secured California DMV approval to expand its driverless operations across the broader Bay Area, North Bay, East Bay, Sacramento, and significant portions of Southern California, while also preparing fully driverless services in a wider set of U.S. cities, including Miami, Dallas, Houston, San Antonio, and Orlando.

Tesla, meanwhile, received a Transportation Network Company (TNC) permit from Arizona regulators on November 17, clearing the last regulatory hurdle to launch a paid robotaxi service in the Phoenix metro area.

On the freight side, Aurora passed 100,000 driverless miles with zero safety incidents on public roads and opened a second driverless corridor between Fort Worth and El Paso, building toward a 1,000-mile autonomous trucking spine across the U.S. Sun Belt.

At the same time, the "invisible" layers that make this viable, edge AI hardware, low-latency 5G cores, private 5G, and high-bandwidth V2X links, saw their own November inflection: Oracle's 5G Standalone core deal with Transatel for automotive IoT, Sutherland and Celona's AI-enabled private 5G/autonomous network solution, a 60 GHz gigabit link targeting robotaxis, and fresh data showing rapid growth in edge AI processors for AVs.

To put it bluntly, November 2025 showed that scaling autonomy now depends less on the next generation of perception models and more on who controls edge compute, private 5G, and corridor-grade infrastructure.

Figure 1: The convergence of edge computing, 5G networks, and autonomous vehicle infrastructure.

Key Autonomous Vehicle Developments

1. Waymo's Biggest Geographic Expansion Yet

California's DMV approved Waymo's request to extend its robotaxi operations across the greater Bay Area (including the North and East Bay), Sacramento, and additional Southern California zones, significantly enlarging its permitted service territory.

Separately, industry coverage highlighted Waymo's plans to operate in additional U.S. cities, Miami, Dallas, Houston, San Antonio, and Orlando, using its Waymo Driver platform.

Why it matters:

This is the clearest signal yet that regulatory trust in Level 4 robotaxis is maturing, and that dense urban coverage will force much tighter integration between AV stacks, 5G macro cells, and roadside/metro edge compute.

2. Tesla Clears Final Regulatory Hurdle in Arizona

On November 18, TechCrunch reported that Tesla received its Arizona TNC permit after applying on November 13, giving it the legal ability to charge for rides as a robotaxi operator in the Phoenix metro area, already a major AV hub thanks to Waymo.

Why it matters:

Tesla now has a clean legal runway to test its robotaxi thesis in one of the most AV-saturated markets in the world, where latency, coverage, and pricing of 5G will directly affect service quality and cost per mile.

3. Aurora's 100,000-Mile Driverless Corridor Network

Figure 2: Aurora's Level-4 autonomous trucks rely on NVIDIA's DRIVE Thor compute and Continental's production hardware to push autonomy out onto freight corridors.

Aurora announced on November 3 that its Aurora Driver surpassed 100,000 fully driverless miles on public roads with zero safety incidents, while maintaining 100% on-time performance for customers. It also launched a second driverless freight lane between Fort Worth and El Paso, complementing its Dallas–Houston route and laying the groundwork for a 1,000-mile multi-state corridor to Phoenix and beyond.

"We've proved the technology works and are now channeling our momentum to support lasting customer value and our path to scale." — Chris Urmson, Co-founder & CEO, Aurora, November 3, 2025

Why it matters:

Corridor-based autonomy is becoming an infrastructure business: whoever controls the combination of HD-mapped routes, edge compute along the corridor, and carrier partnerships for low-latency connectivity will own a defensible logistics rail.

4. Waabi Pushes Beyond Highway-Only Autonomy

On November 25, Waabi announced what it called a "major technical and commercial breakthrough" in autonomous trucking, demonstrating surface-street driving capabilities that let its trucks complete entire freight journeys, both on highways and on general surface streets, without human intervention.

The company positioned this as an enabler of a true direct-to-customer model rather than a hub-to-hub handoff network, and highlighted partners such as Uber Freight and Samsung.

Why it matters:

Full-journey autonomy increases the number of compute-intensive edge decisions per mile and raises the bar on street-level connectivity, especially in messy RF environments inside cities and industrial zones.

5. Global Expansion: WeRide's Fully Driverless Robotaxis in Abu Dhabi

While the underlying launch began earlier in 2025, November coverage continued to highlight WeRide's fully driverless robotaxi trial operations in Abu Dhabi, running without safety drivers across zones including Yas Island, Saadiyat Island, and new coverage of Al Maryah and Al Reem Islands.

WeRide emphasizes collaboration with local authorities on infrastructure and regulation, positioning Abu Dhabi as a showcase for large-scale AV deployment in the Middle East.

Figure 3: WeRide's robotaxi deployments, including its partnership with Uber in Abu Dhabi, highlight how AV operators lean on localized edge infrastructure and 5G coverage.

Why it matters:

The Middle East is positioning itself as an AV and 5G testbed with fewer legacy constraints and strong public-sector capital, attractive for vendors building end-to-end autonomy + connectivity reference deployments.

6. Policy: "United for Autonomy" Coalition & Federal Framework Push

A new "United for Autonomy" coalition of 28 organizations, including OEMs, AV developers, and safety advocates, was announced in November, aiming to push for a consistent U.S. federal framework on autonomous vehicles and move beyond fragmented state-by-state rules.

Why it matters:

A federal framework would lower regulatory friction for nationwide AV and AV-adjacent 5G/edge deployments, especially for interstate freight corridors and nationwide robotaxi offerings.

7. Europe Builds Test Infrastructure: Mobile AV Lab in Estonia

The AV America November recap noted that Metrosert, Estonia's national metrology institute, opened a €900k mobile test facility for self-driving vehicles on November 28, aimed at validating sensor suites, positioning accuracy, and safety systems.

Why it matters:

European test infrastructure is quietly catching up; labs like this will influence how edge-compute requirements, V2X standards, and telecom obligations are written into EU-grade certification.

Edge Computing & 5G: The Quiet Power Layer

1. Sutherland & Celona Launch AI-Enabled Private 5G and Autonomous Networks

On November 12, Sutherland and Celona announced an AI-enabled Private 5G and autonomous network solution that combines Sutherland's Agentic Service Management Orchestration and AI-driven xApps/rApps with Celona's private 5G infrastructure.

The goal: a self-managing, intent-based network for mission-critical environments.

"Enterprises no longer want to manage networks; they want networks that manage themselves." — Sriram Panchapakesan, CEO, Sutherland; November 12, 2025

"Our combined expertise in private 5G innovation and AI-driven network automation will accelerate the global adoption of autonomous networks that are more predictive, adaptive, and sustainable — powering a new era of industrial intelligence." — Rajeev Shah, Co-founder & CEO, Celona; November 12, 2025

Why it matters:

Private 5G plus autonomous network control is exactly what high-reliability AV operations inside factories, ports, yards, and logistics hubs need—this is the "last 500 meters" infrastructure stack for autonomy.

2. Transatel Taps Oracle for 5G Standalone Core for Automotive & Industrial IoT

On November 13, Transatel (an NTT company) announced it is adopting Oracle Communications' cloud-native 5G Standalone signaling core to support secure, low-latency connectivity for automotive, in-flight connectivity, and industrial automation use cases.

The press release explicitly notes that 5G SA roaming and signaling will underpin "large fleets of connected vehicles" and next-gen real-time applications.

Why it matters:

This is one of the clearest November moves showing telco core infrastructure being explicitly reshaped around connected vehicles and latency-sensitive mobility services.

3. High-Bandwidth Links for Robotaxis: Peraso & Virewirx

Peraso and Virewirx announced a collaboration in late November to deliver a multi-gigabit 60 GHz (mmWave) communications link targeted at robotaxi fleets and other mobile edge applications, aiming to support high-throughput, low-latency links between vehicles and edge infrastructure.

Figure 4: High-capacity 60 GHz links like the Peraso–Virewirx VX60 system push terabytes of data per vehicle per hour into edge clusters for training and remote assistance.

Why it matters:

As AV fleets scale, raw 5G alone won't carry the data load; complementary mmWave and WiGig-class links will offload sensor data bursts, HD maps, and software updates into nearby edge nodes.

4. Edge AI Processors: Market Data Catches Up to the Hype

Fortune Business Insights updated its Edge AI Processor Market report on November 17, 2025, estimating a global market size of USD 3.25B in 2025 and projecting growth to USD 10.32B by 2032 (17.9% CAGR). It highlights autonomous vehicles as a key growth driver that requires on-device AI for real-time decision-making and emphasizes that 5G connectivity and low-power edge chips are central to that shift.

Why it matters:

This is the quantitative confirmation: money is flowing into silicon that makes AV-class inference possible at the edge, not just into cloud training farms.

5. Rugged Edge Compute for Off-Highway Autonomy

Advantech's TREK-50N in-vehicle computing system won a Taiwan Excellence Award in late November, with the company explicitly positioning it for autonomous and highly automated vehicles in mining, construction, and port logistics, bringing GPU-class edge AI compute into harsh environments.

Why it matters:

Real money is now chasing autonomy in off-highway segments where private 5G and local edge clusters can be tightly controlled, very different economics from public-road robotaxis, but often with faster ROI.

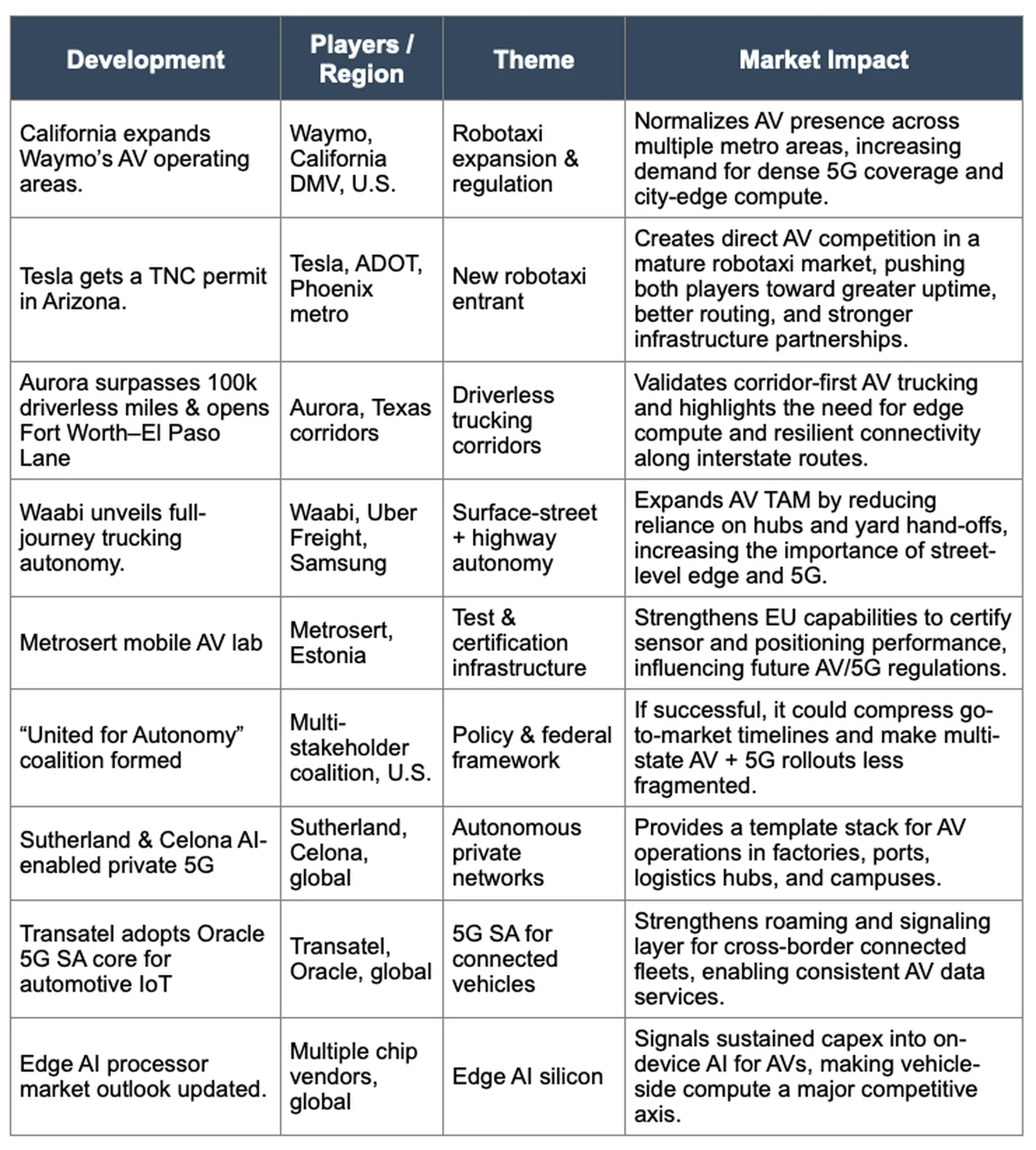

Summary Table: Developments & Market Impact

| Category | Development | Key Impact/Metric |

|---|---|---|

| Robotaxi Expansion | Waymo: CA DMV approval for Bay Area, Sacramento, SoCal expansion | Multi-city scale; regulatory trust milestone |

| Robotaxi Launch | Tesla: Arizona TNC permit for Phoenix robotaxi service | Commercial service cleared; competitive dynamics |

| Autonomous Trucking | Aurora: 100,000 driverless miles; Fort Worth–El Paso corridor | Zero safety incidents; 100% on-time performance |

| Autonomous Trucking | Waabi: Surface-street autonomy; full-journey capability | Direct-to-customer model enabled |

| Global AV Deployment | WeRide: Fully driverless robotaxis in Abu Dhabi | Middle East testbed; infrastructure collaboration |

| Policy & Regulation | "United for Autonomy" coalition of 28 orgs | Federal framework push; regulatory harmonization |

| Test Infrastructure | Metrosert (Estonia): €900k mobile AV test facility | European certification readiness |

| Private 5G / Networks | Sutherland + Celona: AI-enabled private 5G & autonomous networks | Self-managing infrastructure for AV/IoT |

| Telecom Core | Transatel + Oracle: 5G SA core for automotive IoT | Low-latency connectivity for connected vehicles |

| V2X / High-Bandwidth Links | Peraso + Virewirx: 60 GHz multi-gigabit link for robotaxis | Terabyte-scale data offload to edge |

| Edge AI Processors | Market data: USD 3.25B (2025) → USD 10.32B (2032); 17.9% CAGR | AV as key growth driver; on-device AI |

| Rugged Edge Compute | Advantech TREK-50N: Taiwan Excellence Award for off-highway AV | Mining, construction, port logistics autonomy |

Continue reading this premium article

Unlock exclusive industry insights available only to subscribers

Exclusive Research

Proprietary data and analysis not available anywhere else

Competitive Edge

Stay ahead with forward-thinking strategies and insights

Expert Community

Connect with industry leaders and innovative thinkers

Unlimited Access

Unlock all premium content with a subscription