Welcome to TechPulse™

TechPulse™ is your comprehensive weekly guide to the latest developments in Industrial IoT, Telecommunications, Edge Computing, and Autonomous Vehicles. This curated newsletter unpacks the latest news, explains why it matters for business leaders and investors, and provides expert insights to spark your curiosity. Let's dive in!

This week felt different. Not because of any single announcement, but because of how everything connected. Digital twins simulating F1 tracks. Nuclear-powered data centers. Robotaxis navigating Middle Eastern streets. It's like watching separate puzzle pieces suddenly snap together to reveal something bigger.

If you're building a business, investing capital, or leading a team through digital transformation, this week's developments aren't just news; they're roadmaps. And if you're already seeing the patterns we're about to explore, you know why our paid subscribers call these insights "unfair advantages."

Industrial IoT: When Manufacturing Gets a Brain Upgrade

The Week's Breakthroughs

Picture this: Synopsys and NVIDIA just created a digital clone of an entire F1 racetrack. Not a video game. A full physics-accurate simulation that manufacturers can use to test products in real-time without touching physical prototypes. That happened on September 29th, and it's the kind of leap that makes everything before it look quaint.

But here's where it gets interesting.

While everyone's geeking out about digital twins, Equinix quietly partnered with next-generation nuclear technology firms to power data centers. Think about that for a second. The infrastructure that enables Industrial IoT is being rebuilt from the ground up using sustainable nuclear energy. We're not just talking about running more servers; we're talking about fundamentally reimagining how we power the digital-physical convergence.

Meanwhile, Huawei launched SMART Logistics solutions, using IIoT to digitize supply chains in ways that would've seemed impossible five years ago.

And Zayo? They closed a major financial transaction to strengthen the fiber networks that make all of this scalable.

Why Your Future Depends on This

Here's what most people miss: Industrial IoT isn't about connecting machines to the internet. It's about creating a nervous system for civilization itself.

Figure 2: Nuclear Power Emerging as a Clean AI Data Center Energy Source.

If you're running operations, digital twin technology could cut your downtime by 20% through predictive maintenance. That's not a marginal improvement; that's the difference between profitability and irrelevance. Your competitors are either implementing this now or getting left behind. There's no middle ground.

For investors, nuclear-powered data centers represent something rare: a genuine hedge against energy volatility wrapped in a growth story. As AI demands explode and traditional power grids strain, companies solving the energy-infrastructure puzzle will capture outsized returns. The question isn't whether to position yourself here, but whether you'll do it before everyone else figures it out.

"What the Internet of Things is really about is information technology that can gather its own information. Often what it does with that information is not tell a human being something, it [just] does something."

This is eerily prescient today. Read this again. The revolution isn't about better dashboards or prettier reports. It's about systems that think and act autonomously. That future? It arrived this week.

Telecommunications: The Invisible Infrastructure War

Regulatory Earthquakes and Geopolitical Tremors

On September 30th, the U.S. FCC floated something that sounds bureaucratic but is actually explosive: lifting the merger ban among broadcast networks. Translation? Get ready for consolidation that could accelerate the rollouts of 5G and 6G at unprecedented speeds.

Figure 3: US FCC to consider ending merger ban among US broadcast networks.

NATE applauded the FCC's September Build America agenda, which aims to turbocharge broadband deployment. On October 3rd, we learned about UST's partnership with Kaynes Semicon for semiconductor advances in telecom infrastructure. Each piece alone is interesting. Together? They're a clear signal of what's coming.

But then there's the shadow side.

China restricted Nokia and Ericsson equipment in its networks, a reminder on October 2nd that the global tech landscape is fracturing along geopolitical lines. And in Afghanistan, Taliban authorities imposed a nationwide telecommunications blackout starting October 1st, triggering UN intervention calls and exposing how fragile global connectivity truly is.

Why This Changes Everything

Most people see telecom as boring infrastructure. Smart strategists see it as the ultimate bottleneck and opportunity.

For CEOs, regulatory easing means one thing: spectrum auctions are about to become battlegrounds. Whoever controls the airwaves controls the future of connectivity. Miss this window, and you'll spend the next decade paying premium rates to access infrastructure your competitors own.

Investors should look for undervalued telecom stocks poised for consolidation. When regulatory barriers fall, market caps don't add up linearly; they multiply. The companies that emerge from this consolidation wave will dominate an era defined by bandwidth-hungry AI and immersive experiences.

The geopolitical angle? Supply chain diversification isn't optional anymore. If you're dependent on equipment from politically contested regions, you're carrying unpriced risk that could crater operations overnight.

The Afghanistan blackout is a preview of systemic vulnerability at scale.

"Telecom Industry is growing towards a new phase of digital transformation and is poised to significantly propel development across industries while creating more personalized and better user experiences."

What he's really saying: telecom is eating the world. Every industry, from healthcare to entertainment, will be remade by connectivity infrastructure decisions being made right now.

Edge Computing: Bringing the Cloud Down to Earth

Intelligence at the Periphery

Edge computing hit an inflection point this week, moving from buzzword to battlefield.

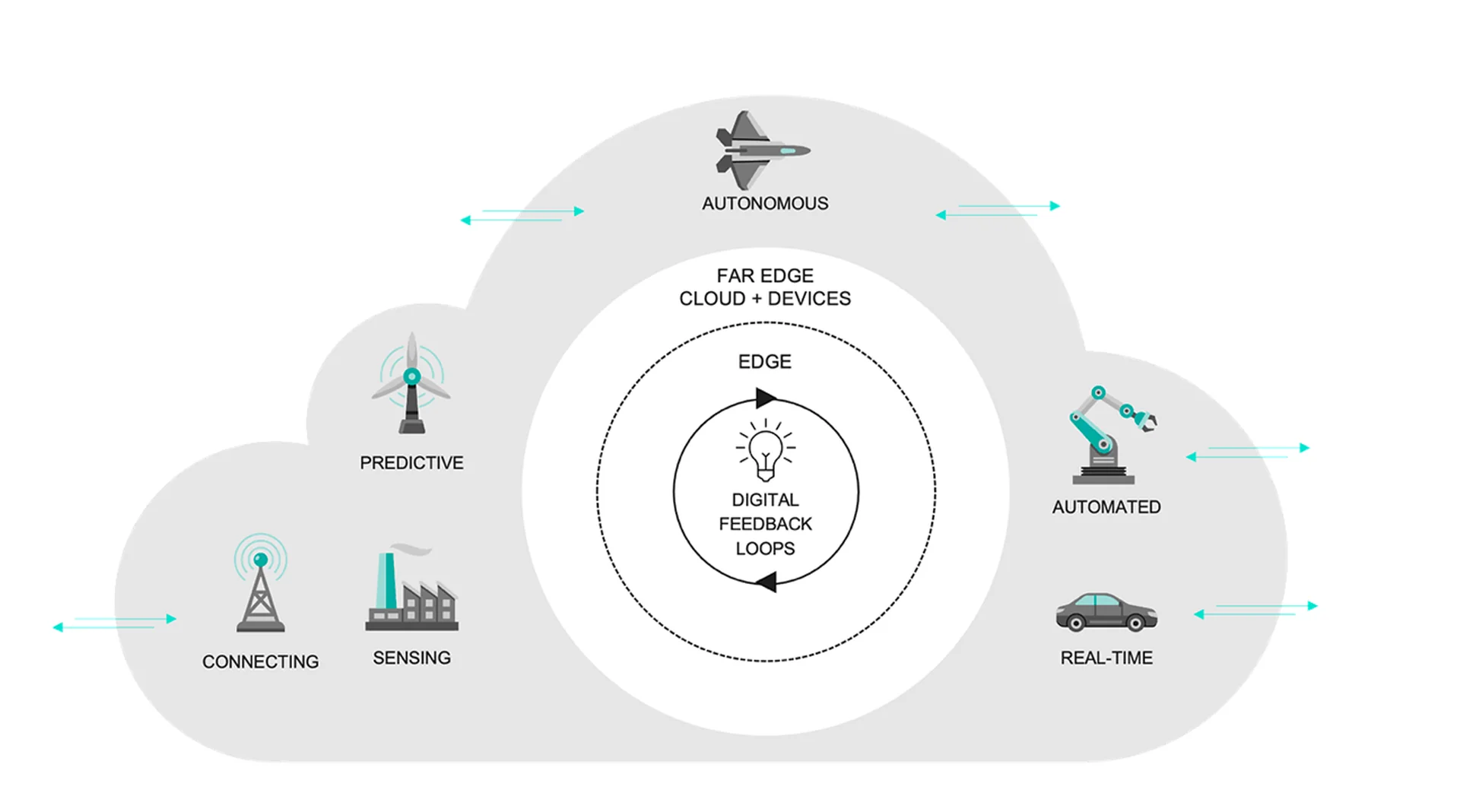

Figure 4: What Is the Intelligent Edge? | Wind River.

On October 3rd, Black Box partnered with Wind River to accelerate intelligent edge and cloud innovations. These aren't just words; they're targeting scalable AI workloads that can't wait for round-trips to distant data centers. When milliseconds matter, the edge wins.

U.S. Customs and Border Protection showcased edge computing at its FY26 tech forum, seeking industry input for security enhancements.

Infineon teamed with Thistle Technologies on October 2nd to strengthen edge security. And KubeCon's North America 2025 devoted an entire co-located event to Kubernetes on Edge Day, tackling the unique challenges of cloud-native infrastructure at the edge.

The Practical Impact

Here's why this matters to your bottom line: edge computing can slash cloud costs by 30% while enabling real-time decisions that were previously impossible.

Imagine a retail store that dynamically adjusts pricing, inventory, and displays based on customer behavior, without sending data to the cloud and waiting for responses. Or a manufacturing line that predicts and prevents defects milliseconds before they occur. That's not science fiction. That's edge computing in 2025.

For executives, the imperative is clear: integrate edge solutions now or risk having competitors deliver experiences that you can't match. For investors, edge AI firms are in that sweet spot where 5G adoption creates demand exponentially faster than supply can scale. Early positions could multiply as infrastructure catches up to capability.

"Edge computing will play a key role for companies looking to get ahead in the experience economy. Core benefits like low latency, scalability and security create superior digital experiences."

Five years later, we're not debating if edge matters; we're watching the winners pull away from everyone else.

Autonomous Vehicles: The Future Hits the Streets (Literally)

Acceleration and Friction

The autonomous vehicle sector delivered both promise and controversy this week.

Figure 5: Partnerships in AV tech like Hyundai-Waymo suggest scalable electric fleets for future transport.

On October 2nd, WeRide launched Robotaxi and Robobus pilot operations in Ras Al Khaimah, UAE, partnering with RAKTA. This isn't a Silicon Valley tech demo; this is a commercial service in a real city with real passengers.

Meanwhile, Waymo announced expansion to Nashville and a partnership with Hyundai for Ioniq 5 SUVs. On October 1st, Waymo's NYC testing permit got extended through year-end, signaling regulatory confidence.

But then reality intruded: a Waymo vehicle received a ticket for an illegal U-turn in California, igniting debates about liability when AI breaks the law. Who pays? The passenger? The company? The algorithm?

Interestingly, GM stock rose 2% during the week, reflecting market optimism about AV technology despite broader volatility.

The Strategic Calculus

Pilots like WeRide's UAE deployment prove that autonomous vehicles aren't perpetually five years away; they're here, operational, and scaling in smart cities globally.

For CEOs, this translates to potential 40% reductions in logistics costs through fleet automation. But it's not just about savings; it's about reimagining what's possible when transportation becomes a programmable service rather than a human-dependent operation.

Investors face a more nuanced calculation. Technology works, but regulatory risk is real. That California ticket isn't trivial; it's a test case for liability frameworks that will shape the entire industry. Focus on companies with exceptional safety records and deep regulatory relationships. Those factors will determine who survives the inevitable consolidation.

"It's important to distinguish between autonomous vehicles and driver assistance and the two approaches to each of them."

This distinction matters more than most people realize. True autonomy and advanced driver assistance are fundamentally different technologies with different risk profiles, timelines, and investment theses. Conflating them leads to poor decisions and missed opportunities.

What's Coming Next: The Convergence Accelerates

Let's connect the dots.

Industrial IoT is merging with AI for predictive analytics that borders on precognition. Telecommunications is fracturing geopolitically while consolidating economically, creating both risk and opportunity at unprecedented scale. Edge computing is enabling AR/VR breakthroughs that will redefine human-computer interaction. And autonomous vehicles are navigating not just streets but the complex intersection of technology, law, and society.

Here's what most analysis misses: these aren't separate trends. They're converging.

Imagine edge-enhanced autonomous vehicles that make split-second decisions using localized AI, communicating through consolidated 5G networks, while IIoT systems optimize traffic flow in real-time. That's not five years away. Components of this are operational today.

With 6G research accelerating and quantum computing moving from lab to application, the next few weeks could reveal cross-market synergies that redefine entire industries overnight.

Final Thoughts: Convergence Demands Decisiveness

This week's announcements tell a story about resilience, innovation, and the brutal efficiency of technological evolution.

From the precision of IIoT to AV pilots expanding globally, one theme dominates: the technology markets are no longer evolving; they're converging into an integrated system that rewards strategic adaptation and punishes hesitation.

The companies and investors who understand this aren't just watching the future unfold. They're building it, funding it, and profiting from it while others are still trying to understand last quarter's trends.

Here's the uncomfortable truth: The gap between leaders and followers in these sectors is widening faster than ever. The advantage of moving first compounds daily. The cost of waiting increases exponentially.

We'll be back next week with more unique insights. Until then, stay curious, stay strategic, and remember: in convergent markets, the bold not only win, but they also define what winning means.

Continue reading this premium article

Unlock exclusive industry insights available only to subscribers

Exclusive Research

Proprietary data and analysis not available anywhere else

Competitive Edge

Stay ahead with forward-thinking strategies and insights

Expert Community

Connect with industry leaders and innovative thinkers

Unlimited Access

Unlock all premium content with a subscription